Amplify your reach and drive results with our tailored paid media strategies.

Over the last few years, the cost of media has been rising, and this trend is expected to continue into 2025. Key drivers of media inflation—beyond general economic conditions—include increased demand for ad space, limited inventory, changes in consumer behavior, and growing platform dominance.

In the U.S., political volatility shaped by new leadership, tariffs, and slowing economic growth is impacting advertisers in several ways. According to recent data, 94% of U.S. advertisers are concerned about the economic climate, and 45% plan to reduce budgets in response. At the same time, political uncertainty and low trust in media—only 7% of Americans express strong confidence—are driving audience avoidance and raising brand safety concerns.

As a result, advertisers are pivoting away from “riskier” contexts like news, politics, and some areas of social media. Instead, spend is shifting toward perceived safe zones like arts, lifestyle, live events, and sports. That migration is pushing up prices in those categories as demand intensifies. Meanwhile, tariffs on imported goods are expected to hit apparel, electronics, and consumer products especially hard, causing some brands to reduce or delay ad investment. A repeat of the post-pandemic playbook—passing costs on to consumers and reinvesting profits in advertising—is likely in sectors with enough pricing power.

While media buying will feel the effects, it is retailers who will be most directly impacted by the 2025 tariff environment. Rising costs—particularly in apparel, electronics, and home goods—are pushing many to rethink pricing, promotion, and checkout strategies. Some are testing value-added incentives and even itemizing tariff-related surcharges at checkout. While transparent, this approach can increase price sensitivity and affect conversion rates.

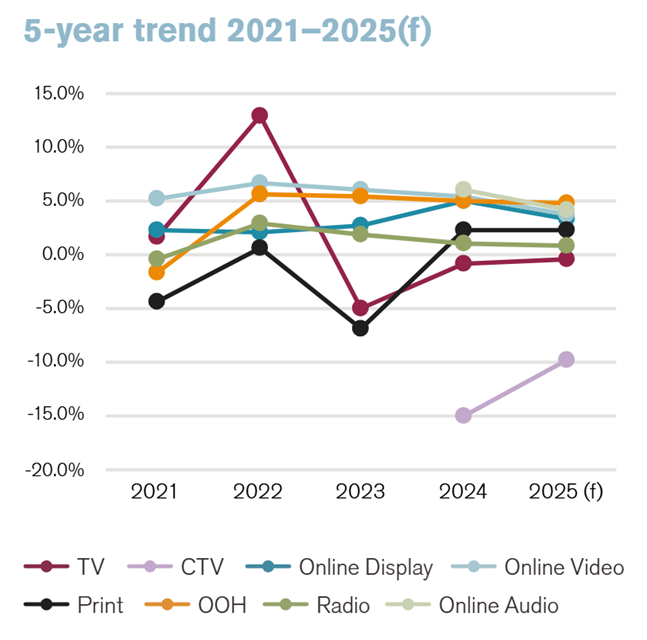

Overall, media inflation in 2025 will be driven by strong advertiser demand and a still-expanding media supply, but within a cautious economic outlook. According to the ECI Media Inflation report for Q1 2025, overall media inflation is forecasted to be at +2.5%, which is a smaller growth figure than +3.4% in 2024. While not as sharp as previous years, advertisers should still expect moderate year-over-year cost increases. Linear TV is losing pricing power due to fragmentation, while digital channels—especially CTV, social, and search—are absorbing higher spend and seeing rising costs. Inflation is cooling, but it’s far from over.

Source: Q1 2025 Media Inflation Report, ECI Media Management

Linear TV is expected to see minimal or potentially negative ad price inflation in 2025. With no major events like the Olympics or a presidential election to drive spikes in demand, the landscape is relatively calm. Many brands continue shifting their budgets to digital, further softening the market.

Although cord-cutting and declining ratings are reducing available inventory, this tightening of supply is being offset by shrinking demand. Advertisers aiming to reach younger audiences are especially likely to pull back. If economic conditions worsen, we may even see zero or negative inflation in scatter markets—particularly in categories like automotive, where tariffs could prompt major spend reductions.

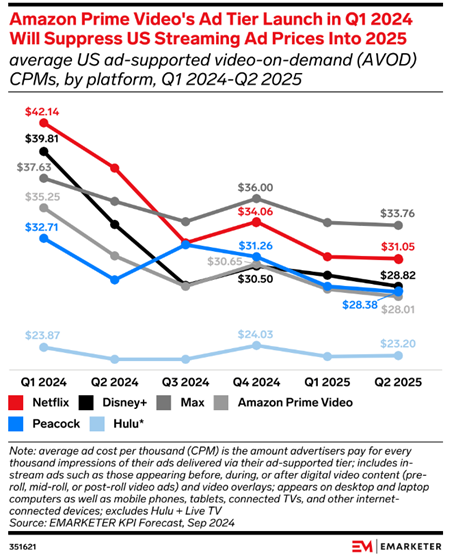

Meanwhile, CTV is charting a different course, driven by a surge in new ad inventory that has helped temper inflation. Over the past few years, nearly every major streaming platform has launched an ad-supported tier. This influx of premium inventory has expanded advertiser options and driven average prices down.

One of the most notable shifts came in early 2024, when Amazon Prime Video entered the ad market with CPMs around $35, undercutting competitors like Netflix and Max. The platform added 50 billion new impressions to the U.S. CTV ecosystem, forcing other streamers to lower their ad rates to remain competitive. As a result, average CPMs across top platforms declined. For example, Netflix’s ad CPM dropped from ~$42 in Q1 2024 to ~$31 by early 2025, according to eMarketer.

CTV remains on a deflationary trajectory. While demand continues to rise as advertisers shift from linear, the rapid growth in inventory—alongside intense platform competition—is holding costs in check. Premium inventory will still command a higher rate, but overall, CTV is emerging as a cost-efficient, high-impact channel well-suited for today’s market.

Social is expected to see increases in ad costs year-over-year. eMarketer forecasts that CPMs across Meta, TikTok, Snapchat, and YouTube will rise in 2025, with TikTok leading the way at a projected 15.6% year-over-year growth. At the same time, impressions have also increased, indicating that advertisers are competing more intensely for audiences across growing segments such as social video and social commerce.

Several factors contribute to the price increases. User growth in the U.S. is flattening, which means inventory and impressions are no longer expanding at the pace they once were. Any increase in advertiser spending against stagnant supply is likely to drive up CPMs. Demand for newer video formats—like Reels, TikToks, and Stories—continues to grow, and these formats often carry a premium. Additionally, many social platforms are implementing tighter limits on ad loads and frequency, which means finite inventory is being stretched further as competition intensifies.

Given ongoing economic strain, messaging strategies across social need to evolve. Brands should shift from urgency to empathy, moving from “buy now” to “we’re here with you.” Leading with price alone risks backfiring in a climate of rising costs. Instead, messaging should emphasize lasting value: durability, versatility, sustainability, and relevance to consumers’ lives. Leaning into local or global brand values can reinforce trust, especially as public sentiment around imports and pricing becomes more sensitive.

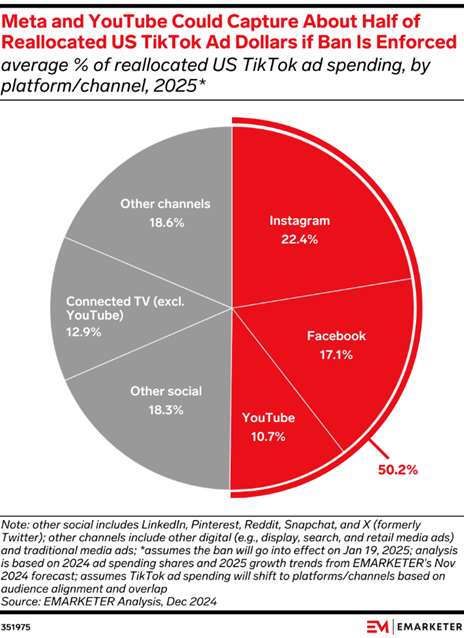

Meanwhile, TikTok remains at the center of market volatility. Its future in the U.S. is still uncertain, and competing platforms are positioning themselves to absorb potential ad spend shifts. According to eMarketer, TikTok CPMs dropped as much as 80% year-over-year in January, as brands sought more stable environments. Pinterest is one of the biggest beneficiaries of this reallocation, with CPMs surging as high as +120%. Should a TikTok ban go into effect, similar shifts—and price swings—can be expected.

Despite the turbulence, TikTok has maintained 90% of its user traffic, proving its staying power with audiences. At the same time, X (formerly Twitter) is showing signs of an ad rebound. With major brands like Comcast and Disney returning, revenue is projected to hit $2.3 billion in 2025—a potential stabilizer if TikTok dollars continue to shift elsewhere.

Source: TikTok CPMs Falling Despite Relevance, eMarketer

Subscribe to our monthly newsletter.

Inflation for display and online video (OLV) advertising is expected to be moderate in 2025. Programmatic display spend continues to rise steadily, driven by automation and strong advertiser demand, which is putting some upward pressure on prices. In fact, programmatic display is expected to account for nearly all growth in the display market, capturing 96.8% of new ad dollars.

For OLV—particularly on platforms like YouTube—demand is also increasing as more brands invest in video content to engage audiences across the funnel. However, this inflation is being tempered by a steady expansion in placement offerings. YouTube, for example, is aggressively growing its Shorts inventory, which helps keep CPMs competitive despite rising investment.

Overall, both display and OLV are expected to see modest cost increases, but strong supply growth and ongoing improvements in platform efficiency are helping to keep inflation in check. For advertisers, these channels offer a dependable balance of performance and scalability in an otherwise fluctuating media landscape.

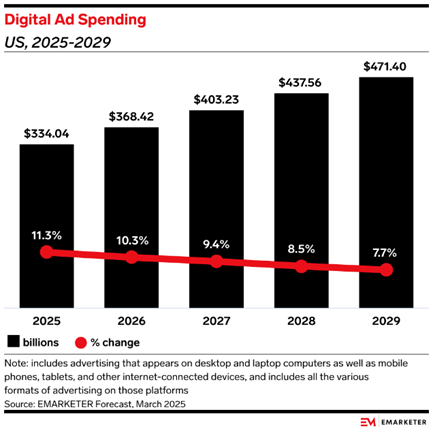

In 2025, paid search advertising is expected to see moderate inflation. U.S. ad spend is projected to grow by over 12%, reaching $144 billion. However, despite this increase in spend, impressions are on the decline—down 15% year-over-year—which is putting upward pressure on cost-per-click (CPC) rates. Cost-per-lead (CPL) is also on the rise, increasing across all industries by approximately 25% year-over-year.

At the same time, click growth is slowing. This is due in part to the growing presence of AI-generated overviews in the search engine results page (SERP), which are reducing the need for users to click on ads. In fact, nearly 60% of all Google searches ended without a click in 2024.

This combination of rising investment, declining impressions, and lower user engagement is driving up the overall cost per result, according to data from eMarketer. To maintain performance, advertisers will need to diversify their approach and focus on long-term value.

Retailers affected by tariffs should also reassess their media-to-margin alignment. Some categories are facing 20% increases in cost of goods sold, which impacts how much they can afford to pay to acquire a customer. Recalculating CAC and ROAS thresholds, shifting spend toward higher-margin SKUs, and segmenting audiences by price sensitivity can help preserve profitability.

Additionally, international advertisers should factor in Digital Services Taxes (DSTs), which range from 2–5% in markets like the UK, France, and Canada. These costs are not visible in platform dashboards and may lead to underreported CPAs or ROI if not tracked at the invoice level. Finance and media teams should align to ensure global spend is accurately forecasted.

More efficient keyword targeting and refined performance strategies will be essential for sustaining ROI in an increasingly competitive environment. Capping CPCs can help maximize bid volume within budget and reduce cost-per-outcome. Brands should also continue investing in upper- and mid-funnel efforts to encourage engagement and drive conversions further down the line. Creating valuable content that resonates with users and boosts organic visibility will help support broader brand-building goals. Finally, optimizing landing page experiences will be key to improving conversion rates and maximizing every dollar spent in search.

The outlook for media inflation in 2025 is more optimistic than in recent years. While political and economic volatility remains, overall media inflation is expected to ease: +2.5% in 2025 compared to +3.4% in 2024.

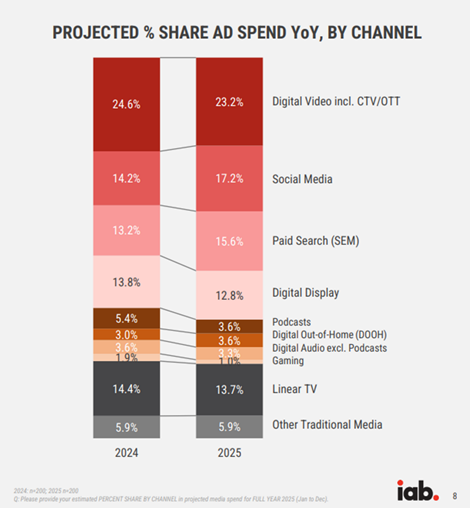

Ad spend is projected to grow +7% year-over-year, but at a slower pace than 2024’s event-driven surge. This signals a more stable, yet still competitive, environment that rewards strategic, full-funnel planning and agile execution.

Digital channels are under the most inflationary pressure due to rising demand and limited inventory. Linear TV costs are flattening, while CTV inflation is decreasing as supply grows and audiences continue to shift. Meanwhile, social and search are seeing rising costs driven by tighter ad loads, new formats, and evolving SERP dynamics.

Brands that pull back on spend now risk losing visibility and long-term market share. During previous tariff cycles, companies that paused media efforts experienced longer recovery times and higher reacquisition costs. With retail sales still forecasted to grow 2.7–3.7% in 2025, staying active and adapting remains the better path forward.

Looking ahead, advertisers should consider prioritizing CTV, linear TV, and premium video for efficient reach. In search, fine-tuning keyword strategies and capping CPCs will help control spend. Keeping a close eye on TikTok’s regulatory future is also key, as shifts could trigger CPM spikes on Meta and YouTube.

Volatility will continue—but brands that stay visible, empathetic, and proactive will win. Aligning operational awareness, performance planning, and adaptable messaging will be key to standing out in 2025.

Amplify your reach and drive results with our tailored paid media strategies.

Amplify your reach and drive results with our tailored paid media strategies.

Subscribe to our monthly newsletter.