Insider-q-western-unions-jocelyn-da...

Insider-q-western-unions-jocelyn-da...

Marketers are placing an increasing emphasis on being visible and relevant in very specific touch points of the customer journey. I had the pleasure of speaking with Joycelyn David, Head of Digital at Western Union Canada, to learn more about how the brand is expanding its digital reach and why marketers need to prioritise localisation and personalisation across all channels.

How has Western Union stayed ahead of the digital curve?

Western Union has been providing its financial services to Canadians for 25 years. We consider investment in digital capability to be critical to remaining relevant to our diverse customer base. Consumers who move to Canada from different countries may have different preferences when it comes to internet use, in-person interactions or trust in financial institutions. But they all deserve the same respect when it comes to reliability and speed. Digital needs to be a tool to help bridge customer experience and convenience. Consumers know what they prefer and they will vote with their wallets.

Western Union recently announced the launch of its mobile money transfer app in Canada. How important was this launch and what will it mean for your Canadian customers?

Yes! Western Union has launched its first-ever mobile platform in Canada for domestic and cross-border money transfers, available for all Android and iOS devices. Merging the concept of physical and digital money transfers, the new app allows customers to send money directly from their mobile phones. But a user of our app is not limited to sending money to other users of the app. They also have the full benefit of Western Union’s physical infrastructure: over 100,000 ATMs and kiosks, and 500,000 Agent locations across more than 200 countries and territories. This new mobile money transfer app builds on Western Union’s ubiquity, putting our leadership, reliability and convenience in your pocket, virtually wherever you happen to be.

With just a few clicks, Canadians will now have access to the following key features:

- Send money on-the-go, any time, to more than 200 countries and territories

- Check current exchange rates and fees

- View past and pending transactions

- Get access to round-the-clock customer service

- Track money transfers directly from their mobile device

- Discover the locations of Western Union’s Agents — 500,000 worldwide, with nearly 3,300 in Canada alone

We have seen national brands digitising traditional marketing tactics to compete in local search. How important is it for marketers to prioritise localisation and personalisation?

Vitally important! In today’s multi-touch, multi-device environment, companies need to prioritise localisation in order to ensure accuracy and visibility of their brand.

Why should financial marketers continue to target digital channels, primarily with local search?

An investment in localisation shows a commitment to meeting customers where they are, in the moment — whether on a smartphone or at a local storefront, or both at the same time!

E-Marketer reported earlier this year that time spent on mobile devices in Canada is expected to exceed 25% by the end of 2016. What consumer behaviour trends have surprised you as mobile search continues to grow in Canada?

While this stat is powerful from a marketing perspective, it does give me pause as a consumer and as a mother. In my opinion, our mobile devices cannot replace human interaction and connections that are vital to professional and personal relationships and the building of strong communities and families. Have you ever seen a family sitting together at a restaurant table — all on their phones? That is one consumer trend I truly hope does not grow! For my own family, we encourage “no-tech” time as best we can — and that includes my son telling me, “Mommy, time to put your phone away!”

If a company hasn’t yet been active in local search, what are some of your recommendations on how they can get started?

Go to your favourite search engine. Type in your brand or company name, and see what pops up. Is it accurate? Is it what you would want to see as a customer? If the answer to either of these questions is no, then it’s not too late to start.

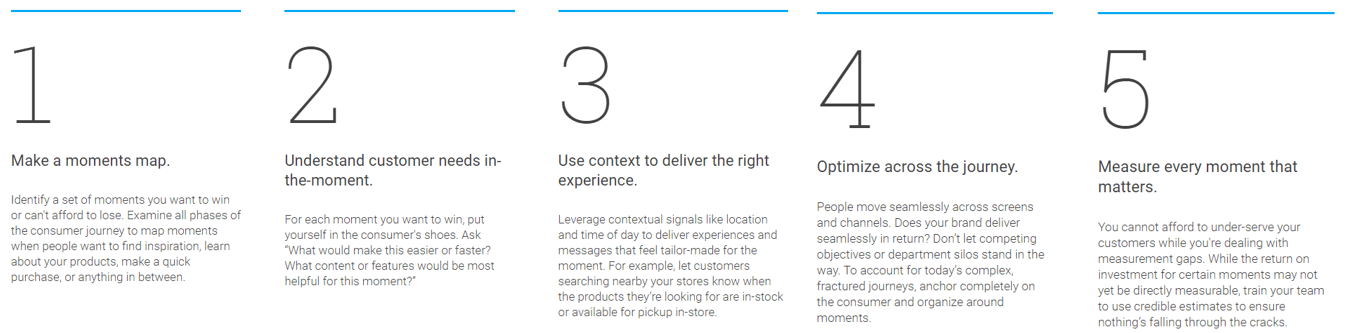

For marketers looking to appear relevant and build trust, Think with Google has a few key steps on how to start taking action:

Interested in hearing what more industry experts have to say about their digital marketing strategies? Contact DAC today!