Why-financial-advisors-should-have-...

Why-financial-advisors-should-have-...

While customers often visit a business for the business itself, there are many instances in which the customer is not invested in the brand but rather an individual working within it. For businesses like doctor’s offices and law firms, clients are largely the individual practitioner’s customer base rather than the office’s.

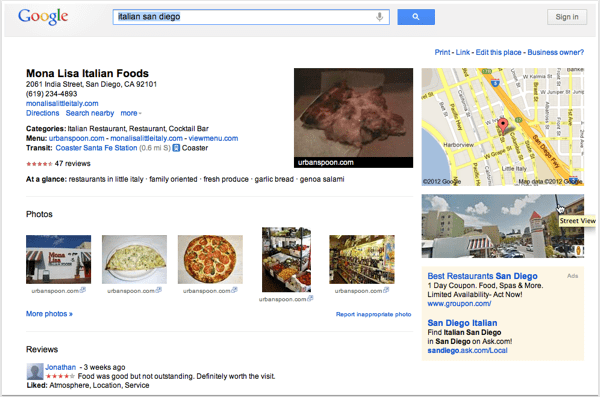

While it may seem that Google My Business is dedicated to brands and enterprises, the platform offers significant support to promote an individual practitioner of any profession. With niche websites being created to showcase local real estate agents, contractors, and doctors, it was only a matter of time until Google picked up on this need and offered the same service within their platform. Practitioners in all fields—and financial advisors in particular—should take advantage of this and use GMB to help sell their services. Here’s why.

The case for displaying individual listings

From a bank’s perspective, displaying their individual advisors’ listings on Google and other websites will provide more exposure for both the practitioner and the bank itself. More listings are always better, as each one could be the listing that ranks for a user’s search. It also gives enterprise-level banks a chance to rank on websites that show individual advisors rather than general financial institutions.

Individual advisor listings are also categorised differently on Google and other platforms. This gives your brand a far better chance to rank on not only searches for “bank” and your brand name but for searches such as “stock broker” and “mortgage information.” There is a benefit not only for overlapping search terms between your branch and its financial advisors but also for long-tail keywords and categories that only your advisors would fill.

In recent months, Google has also made the problems of dealing with multi-practitioner listings less taxing. Practitioners previously were tied to the office address in which they worked, which caused issues if the advisor retired, moved, or otherwise was no longer working at that location. Now it’s a simple address change if the practitioner changes locations—and it’s possible to close the practitioner’s listing without it having any effect on the listing for the office they worked within.

Creating a practitioner listing

There are three types of practitioner listings that can be relevant when creating them on Google: either multiple practitioners at a single location, a single practitioner who represents the brand at that location, or a fully independent individual.

For multi-practitioner businesses, there are two caveats for creating individual practitioner listings on Google My Business:

- The organisation should create a listing for this location, separate from that of the practitioner.

- The title of the listing for the practitioner should include only the name of the practitioner, and not the name of the organisation.

There are also three requirements for an individual practitioner:

- He or she operates in a public-facing role. Support staff should not create their own listings.

- He or she is directly contactable at the verified location during stated hours.

- A practitioner should not have multiple listings to cover all of his or her specialisations.

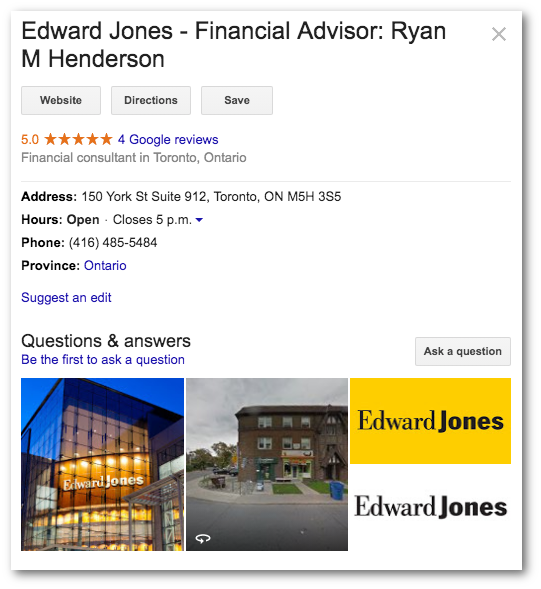

There is, however, a difference if the practitioner is independent or if he or she is the only public-facing practitioner at a location and represents a branded organisation. A financial advisor that represents their bank has the advantage of being able to include the name of the brand along with their own information. The format Google prefers is: [Brand/Company]: [Practitioner Name]. For example, “DAC: Zoran Dobrijevic”.

Maintaining your reputation

Financial advisors have an incentive to update, maintain, and keep their Google My Business listings highly presentable because, along with the general benefits of gaining clients through professional listings, a financial advisor who leaves their parent organisation for whatever reason can keep their unique listing. Their information, along with all the reviews they’ve generated, belong to them and they can maintain their reputation when moving on to a different business. This also means that if there is a sole advisor who represents a bank or business, they can transfer ownership of that listing to a new advisor. Whether the advisor separates from the bank, moves to a different branch of the same bank, or is replaced, Google makes it very easy to maintain reviews and other positive Search Engine Optimisation factors as the listing changes hands. There is no need to build goodwill and domain authority from scratch unless desired.

It is beneficial both for the banks and their advisors to separate their listings when they can. More exposure for both parties will only increase their client bases. It will also look far better on both the bank and the advisor if they have professional listings showing their services when a competitor does not. If a user is looking for a bank listing, they will not have to wonder if an investment advisor is available at that branch when there is a separate listing showing just that service.

If you are a bank wanting to increase your online presence or those of your advisors, get in touch with DAC. DAC can help expand all your branch listings to promote both your institution and your individual advisors.